When should I sell my stock options?

When is the best time to sell my stock?

As many of you know, I work for a late stage venture backed startup. Last week, my company raised a large new financing round at a lofty new valuation. It’s cause for celebration, but also contemplation. Management is giving us the opportunity to sell 20% of the shares that we have already vested in the company at the per share price of the newest funding round.

Since I joined two years ago, my shares have appreciated by over 10x. Although this new round values the company aggressively, I also believe that we have the potential to significantly outgrow this newest valuation within the next 2-3 years. This means that if I sell now, I might miss out on bigger gains down the road.

On the other hand, with a startup ANYTHING can happen… so I don’t want to miss a potential opportunity to monetize the hard work that I have already put into the company. Last year, I told the story of my own stock option sale, and the difficult lessons I learned from not selling my stock when I had the opportunity.

So, do I sell my stock options? And if so, how many? The only way I can answer the question is by applying some coldhearted logic to the sale: my 25% Plan!

The 25% Plan: A method for obtaining the best price for my stock

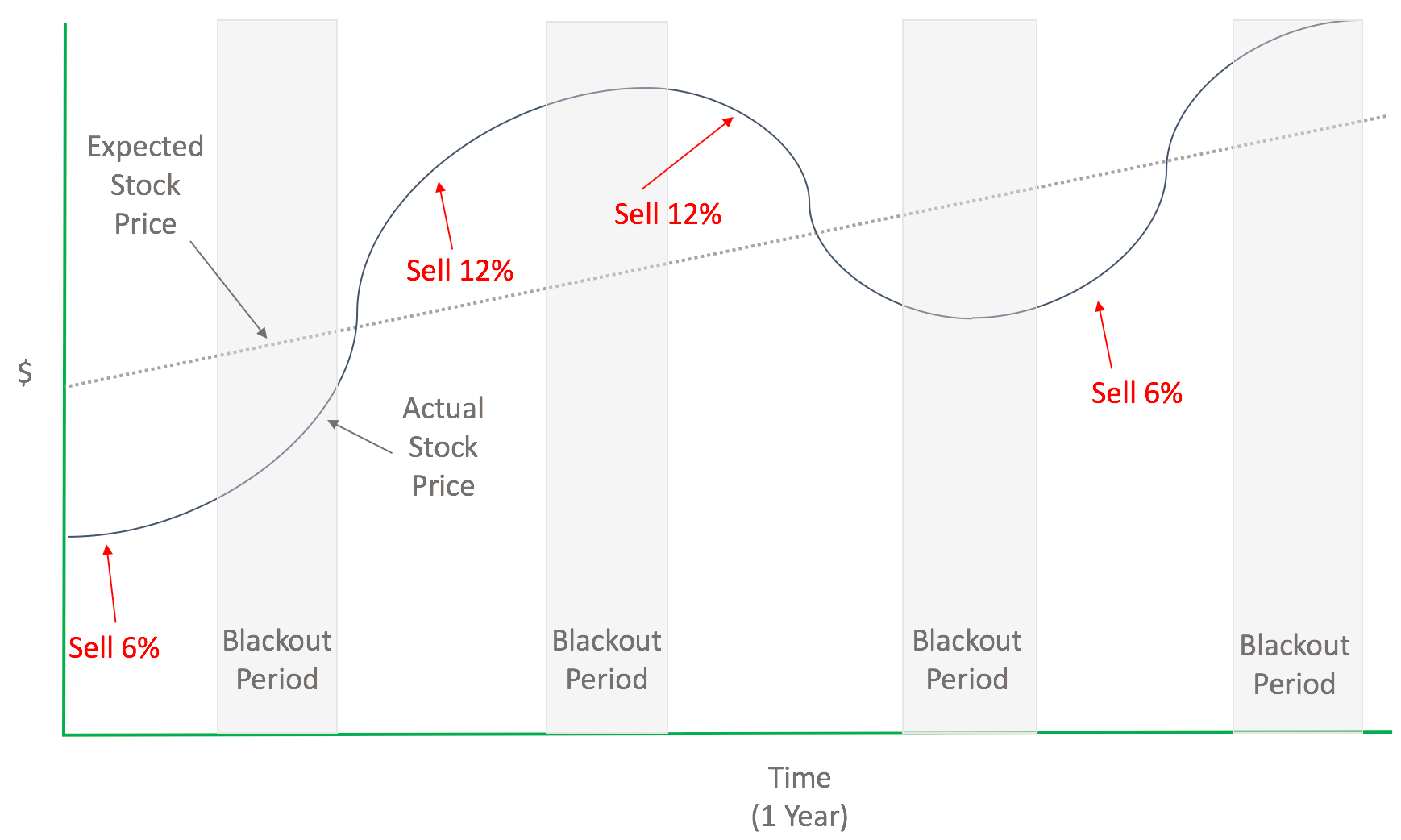

The 25% Plan is quite rudimentary overall. Any time I own a highly volatile asset that’s difficult to price (like stock in my current startup), I make a plan for selling the stock as time goes on so that I can diversify into other assets. I also want to ensure that I get the maximum price possible from the sale of the stock, although it’s impossible to time things perfectly of course. The only way to take money off the table while maximizing my potential gain is to sell a small amount at periodic intervals: dollar cost averaging, basically.

Here’s how I do it.

Step 1: Make a line from the current price to the future price

In order to know how much I should sell at any given point, I need to know what my EXPECTATIONS are for the stock at any given time. The way that I do that is simple. I make a straight line from whatever the current price is, to the price that I expect it to be at in 4 years.

When I started at my current company, I expected the IPO to be sometime around 4 years from my start date, at somewhere around $40 per share. My strike price is around $4, so that represents a 10x return. Of course, that is just my expectation, there’s no rule saying that the stock has to do that well!

But how do I determine what I expect the price to be? Extrapolating what the price could be in the future is difficult. One way I simplify this for myself is by asking what a good outcome would be. What is a reasonable price for this asset, a price that I would be happy with 4 years down the line? If I were looking at an investment in the S&P 500, I would want to get 10% a year. For some assets, I just don’t want them to go DOWN in value, so the line is relatively straight. Obviously, my expectations for my current organization are quite bullish, given that I think it will 10x within 4 years.

Whatever the number I choose, the most important thing is that I am honest with myself. This is a value that is possible… even probable… and it’s a number that I would be happy with, all things considered.

Step 2: Start selling (when I can...)

After drawing a line from the present value to the future, my expectations are very clearly established. At any given moment, I can look at my chart and know whether the current price meets, exceeds, or fails to reach my expectations.

Generally, if my expectations are exceeded, it’s a great time to sell. I’m getting more than what I planned for! In my current situation, the current share price is around $30/share. After only a year and a half at my company, that isn’t too far from my $40 target for 4 years. In other words, I am way above my expected value, which means that I should sell at least some of what I have.

Unfortunately, selling can be a challenge. I am really lucky that my company is allowing me to sell 20% of what I have currently vested in this private financing round, otherwise I would have no way to monetize my shares until we IPO. What’s more, after an IPO every employee has to hold onto their shares through the end of a mandatory “lockup period”, which is usually around 6 months. There are additional lockup periods once the company is public leading up to and after earnings releases (this is to prevent insider trading). In other words, it’s only possible to sell shares 8 out of every 12 months.

My personal goal once I have achieved some liquidity with my stock is to divest around 25% of what I have vested every year. For each “non-lockup” period after earnings, I aim to sell around 6% of my total vested stock (4 x 6= ~25%). Whether I am done vesting, or I have significantly more shares to vest, I determine what I sell based on what I have already vested.

As for my current situation, I am allowed to sell 20% of what I have currently vested, so even if I wanted to there’s no way I could sell 25% anyway.

Step 3: Sell high!

The last part of the 25% Plan is crucial: when the price is higher than expectations, I sell!

Every once in a while, things work out better than expected and the price of my stock is significantly above my expectations line. My goal is to sell 25% of what I have vested every year, or 6% at the end of every lockup period, but if the stock price is above my expectations, I let myself sell up to 12% at a time. You can see what I am talking about below:

Currently, the stock in my company is $5-8 above where I expect it to be, so I know it’s a good idea to take some money off of the table. At the same time, I can only sell 20% of what I have currently vested, or around 10% of my total grant (I have been at the company for almost 2 years and the grant vests over 4 years). This is probably a good thing, since I expect the stock to continue appreciating over time. The image below from my Personal Capital vesting schedule shows the total number of shares I have available to exercise, which is a relatively small portion of my total.

Time to take some money off of the table

Quite simply, I can’t sell much of what I have right now, and the price is way above my expectations, so I am going to exercise and sell the maximum number of shares that I can. After my experience at Tableau I know: it’s best to walk away with sometime you’re happy with than wait and walk away with something far far less.