A deeper look at "The 25% Plan"

A couple weeks ago I told the story of my own stock option sale, and the lessons I learned from it. This week I wanted to dive into the plan I laid out at the very end of the post, the "25%" plan, and go into some more detail.

The 25% Plan

The basic idea is quite simple. Anyone who owns stock in a highly volatile and difficult to price stock (like say, a Unicorn that just IPO'd), should have a plan to divest at least some of that stock as quickly as possible and diversify. But, it's important to maximize the money from the sale of that stock as well. In an unpredictable and completely erratic marketplace, it's essentially impossible to time the market, so my solution is to sell a little bit at a time over the course of 4 years. Dollar cost averaging, in other words, with some slight modifications.

Step 1: Draw a line into the future

The first step in this plan is to figure out a reasonable guess for the stock price 4 years from now and then draw a line from the current price to that value. It might be the same price as it is now, less, or 4x the current value. It's a difficult thing to do, because the price is at the whim of the market. Some startups go public, charging out of the gate with a 50-70% "pop". Others, like Facebook for example, IPO high and then lose 30-50% of their value over the course of the next 6 months.

Because it's so unpredictable the most important thing to determine isn't what I think the market price is going to be, but what I think the price should be in four years. If I think the company is on tenuous ground, and the stock is going to slide, then my line will be downward sloping. If I think the company is going to the moon, then my line will be upward sloping. Either way, it's important for me to be honest with myself. Once I have a line from the current stock price to the stock price in 4 years, I should have a chart showing the expected value at any time over the course of the next 4 years. It won't bear any relation to reality, believe me, but that's actually totally fine.

Step 2: Start selling (when you can...)

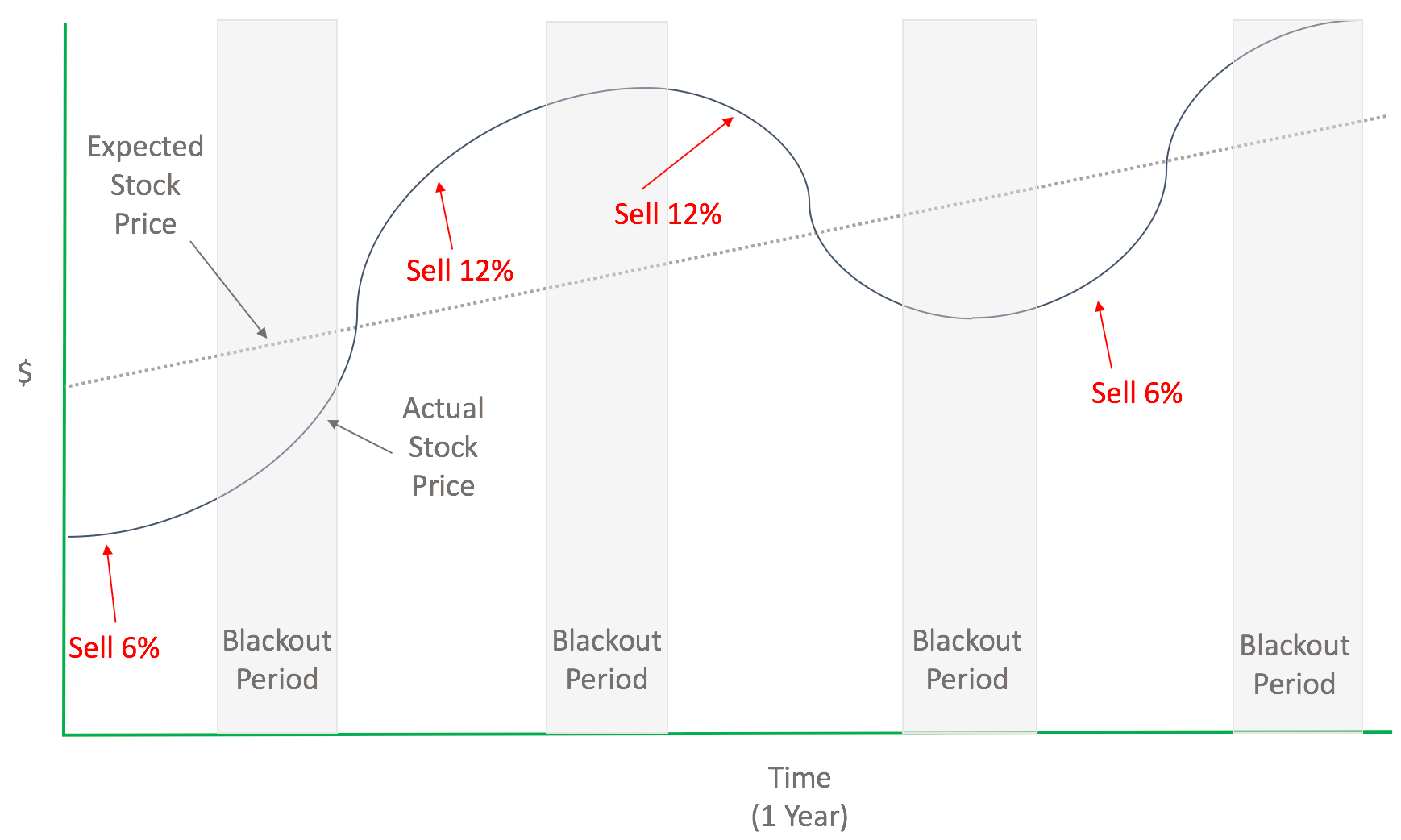

Selling isn't quite as straightforward as it sounds. Most of the time, startup employees can't sell their stock until 6 months after the IPO. This "lockup period" isn't just a one time thing either - every month before earnings is also blacked out on the calendar for selling. This means that there's only 8 out of 12 months in the year that sales can occur - and in my experience those periods always seem to coincide with all time lows in the stock price.

In any case, the plan is relatively simple plotting the line. The goal is to sell at least 25% of my stock every year. This means, in each of the four "non-lockup" periods after earnings, I will look to sell 6% of my total vested stock (25%/4=~6%). I may be done vesting, or have many more shares to vest in the future, either way I always calculate it based on the current vested stock.

Step 3: Take advantage of the jumps

Occasionally, the stars will align and the actual stock price will be higher than the expected value (my "line"). In this situation, I will double the amount I sell to 12% to take advantage of the higher than expected price.

It's important for me to continue selling 6% at a time in every open period, even when the stock is lower than expected. Frankly, most of the time it WILL BE lower than expected, so I'd never sell and the plan wouldn't work at all if you skipped the "bad" sales.

Take a look, for those that are more visual:

Conclusion

Everyone has their own personal feelings about this kind of thing, and I would definitely not suggest that anyone take my plan and use it because it’s my plan for me. But, it's a useful construct to think about ways to take the pain and guessing out of selling stock options.