A plan for selling stock options

Avoid FOMO and failure when selling your options

The hardest part about being an owner in anything is knowing when -or if- you don't want to be an owner anymore. For anyone who has ISO or RSU stock options, you know what I'm talking about. If you sell your stock and it skyrockets afterwards, you locked in a lower price (and massive FOMO). If you DON'T sell, and it tanks afterwards, you are stuck with a bunch of nearly worthless stock.

Of course, there are usually tax implications to think about as well, certainly for those who are holding ISOs that were purchased less than a year ago. Today, I'm approaching the subject of selling without thinking about taxes; I'm assuming you've read my post about that and will adjust accordingly.

A real life case study

After going through this myself with $DATA, and doing it almost completely wrong, I consider myself an expert in how NOT to do think about this. As you might imagine, I've also developed a much better plan for the future to ensure that I don't mess up quite as bad if I'm in a similar situation. Please feel free to learn from my mistakes! Here's a quick synopsis of my thinking over the course of 3-4 years of vesting and ownership in Tableau.

Yup. Pretty rough ride. And to be honest, this is not even that crazy for many newly public companies. The volatility is insane. To get why this is so hard, you really have to put yourself in the moment. Note that I'm giving you my actual actions here and the actual sale price, but the number of shares is fake.

November 2013 - First Post-Lockup Sale - 50% of 1000 shares vested - $54 a share

It's November and $DATA just left its lockup (mandatory holding period for employees post-IPO). I know I have around 500 shares vested out of the 1000 I was granted, and after years of waiting, I'm fairly eager to sell and turn my hard work into cash. That being said, the future looks bright and the stock already went up $10 per share in 6 months, so it seems smart to hold on to some of it. I sell 200 shares, and keep 300.

Proceeds: 200 * $54 = $10,800

May 2014 - Second Sale - 60% of 1000 shares vested - 800 shares remaining - $63 a share

At this point, I'm frustrated. Tableau had run up almost to 100 around the beginning of the year, but I didn't sell anything because A) We were in a periodic quarterly lockup and B) After we left the lockup, I felt it could go higher. After dropping back down to $60, I decided to sell 100 more shares.

Proceeds: 100 x $63 = $6,300

*After this sale, I hold onto my stock for a long time, hoping for appreciation.

May 2015 - Third sale - 80% of 1000 shares vested - 700 shares remaining - $116 a share

WOW. $DATA has run up in the past year to $116 a share. Looking at the stock price I know, deep down, that it's a little ridiculous. Bit, the company is growing really really fast, there are new innovations on the horizon, the entire company is pumped up and I decide to capitalize - just a little - on the insane appreciate in the stock. But, I am still kicking myself for already having sold 300 shares at almost half the price, so I know I don't want to feel that way when the stock hits $200 or $300 a share. Because OBVIOUSLY it will, someday. I decide to sell 50 shares... and take a vacation.

Proceeds: $116 * 50 = $5,800

November 2015 - Fourth sale - 90% of 1000 shares vested - 650 shares remaining - $100 a share

After shooting up to $130, the stock went back down to $80, and after a successful earnings call jumped back up to $90. Now, I'm a little spooked. I know I have to sell something to lock in my gains, but that massive fear of missing out on a return to $130 or higher makes me want to keep most of what I have. I sell 150 shares.

Proceeds: $90 * 150 = $13,500

May 2016 - Last sale - 100% of 1000 shares vested - 500/1000 shares sold - $40 a share

Revenue comes in below expectations and Tableau stock TANKS. This sucks. SUCKS. Six months ago, I was holding onto $50,000 worth of Tableau (500 shares x $100 per share), and now, it's only 40% of that. I decide to sell it all, and walk away with what I have. It's still my largest sale, in dollar terms, but it all could have been so much better. Absolutely agonizing.

Proceeds: 500 * $40 = $20,000

What did I walk away with? And... how much better could I have done?

Tallying up all of the proceeds, I walked away with around $56,400. If I had held onto every share and sold them for at least $100 per share (more or less), I would've walked away with nearly $100,000.

It might seem like I made a litany of bad decisions here, but in all honesty I think I only made one really big one. My first two sales were understandable and smart - it was a good decision to cash out a little of what I had to make sure I walked away with something. But, I should've sold much much more when the stock was over $100 a share. That would have left me with less to sell when it tanked, significantly increasing my take home with one move.

I don't really regret selling the 500 shares at the end - although someday I'm sure Tableau stock will be worth much more, it wasn't worth it for me to keep sitting around watching it go up and down. That's the part that isn't obvious just looking at the charts. Every swing, whether good or bad, is a jarring event. It makes you re-evaluate all of the shares that you have left, and constantly second guess yourself. After three or four years of that, I was ready to diversify into less volatile assets and move on.

A better method for the future

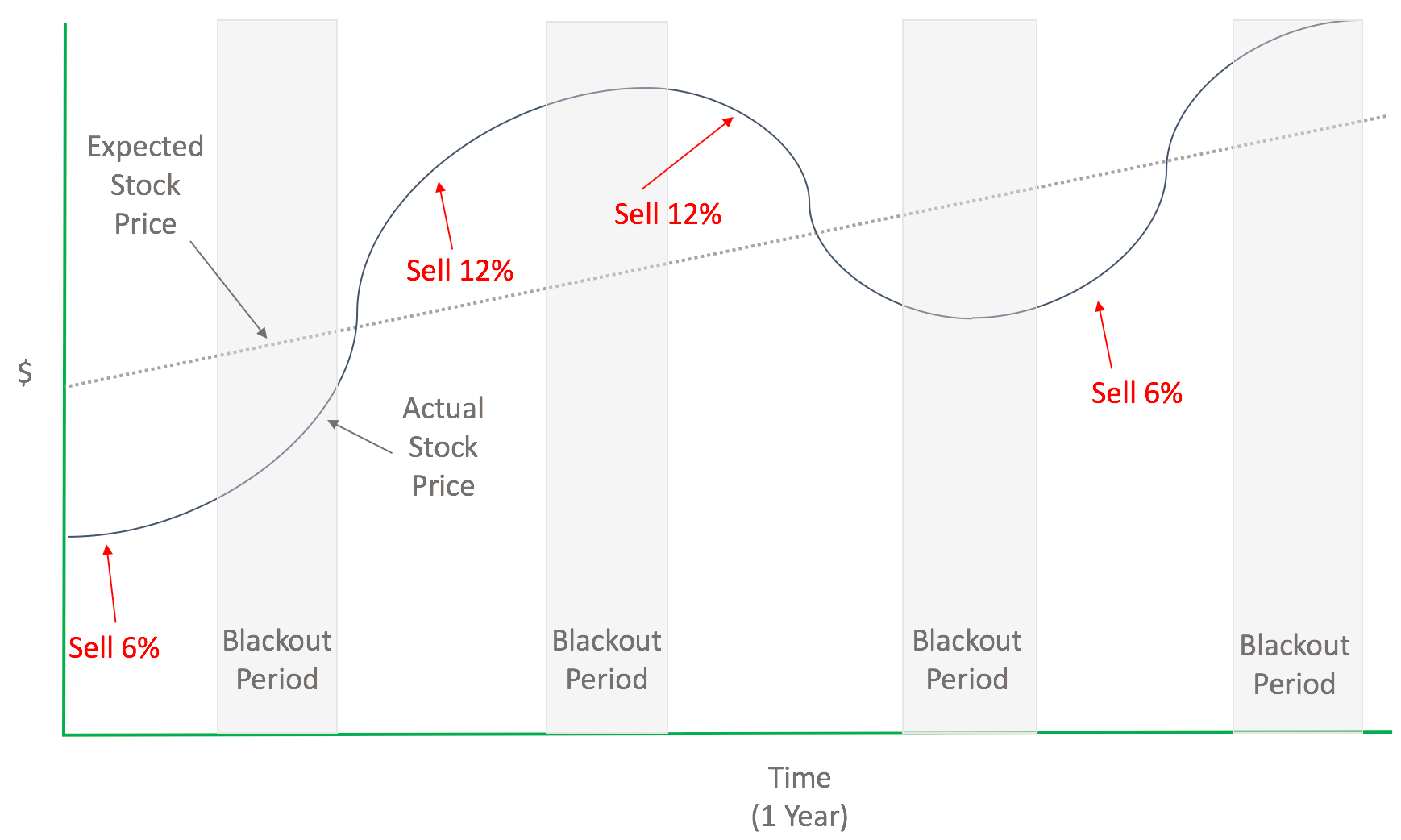

My method for the future is going to be much easier on myself: I'm dollar cost averaging. Each year, I will sell 25% of whatever I have vested. If I see a situation like I did at Tableau, where the stock shoots up to well over its fair market value, then I'll give myself the flexibility to sell another 10-15% that year. Similarly, if the stock drops (and I have a very good reason to believe it will retain and pass previous values) then I will always have the choice to sell a little less, maybe 10-15% of what I have instead of 25%.

The truth is that you can never time the market. You can't guess where the stock will be in one year or three. The market makes absolutely no sense in the short to medium term, so trying to apply logic to it is pointless. The best thing you can do is to remove your own emotional decision making from the process. That's why I am dollar cost average my ISO and RSU stock sales in the future. Would that work for you? Only you can know.