How to get started real estate investing in expensive cities

How to start real estate investing in an expensive city

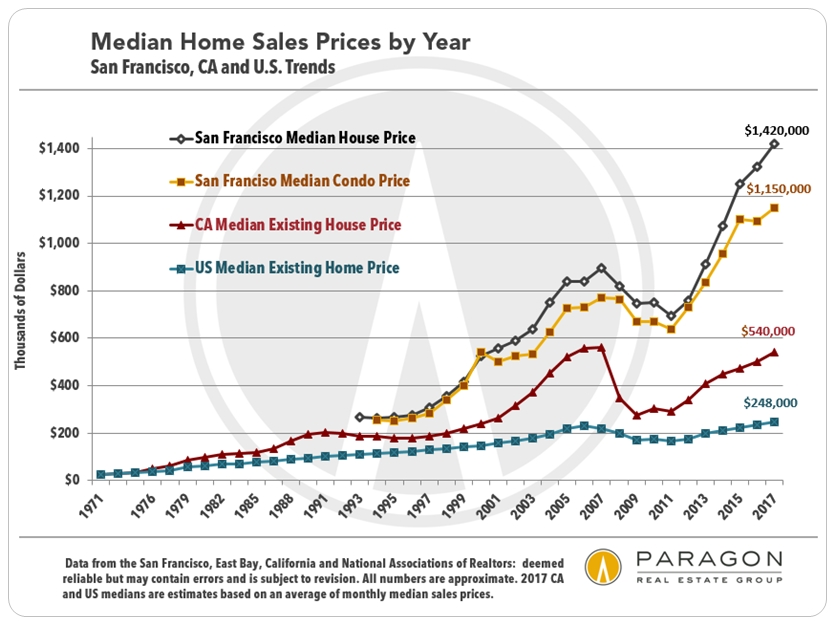

Getting started with real estate investing can be tough. Real estate is generally quite expensive, so the price of entry is high. Even a modest single family home in a relatively low cost of living city like Indianapolis or Spokane start in the $150-250k range, meaning a 20% down payment would be at least $30k. Even for a high earner, that’s a large chunk of change to set aside for a single investment, and the numbers can be much bigger than that in high cost of living cities. The median price of a home in San Francisco is well over $1m. That’s a $200k down payment, if not $300.

Although it can be an expensive proposition, there are enormous benefits to real estate investing. Buyers have access to an unprecedented amount of leverage through the subsidized 30 year mortgage industry in the US. If you buy a $500k home at 20% down and it appreciates 10%, your equity actually appreciates 50% (because you go from $100k in equity to $150k).

Mortgages are also tax deductible to some degree in the US, and rental homes can also be depreciated, ensuring a relatively low tax burden for real estate income.

Why is it so hard to get started in real estate investing in expensive cities?

Naturally, there are quite a few people who want to know how to get started in real estate investing to take advantage of these benefits, but buying a single family home as a rental in an expensive market will simply never work.

For starters, a $1m home in San Francisco with a 20% down payment will leave the owner with an $800k mortgage and anywhere from $5000-$6500 in payments every month, depending on the interest rate. Even worse, because homes have appreciated so much in cities like San Francisco, New York, Seattle and LA, median rents are significantly lower as a percentage of the purchase price. This means that the rental income on the property likely won’t even cover the cost of the mortgage. Ongoing maintenance and property taxes make the economics look even worse.

What are some good ways to get started real estate investing in high cost of living areas?

You might think that it’s impossible to get started in real estate investing if you live in an expensive coastal city, but that simply isn’t true. There are numerous ways to get your foot in the door and benefit from the natural advantages of real estate investing in cities with dynamic and growing economies (and therefore expensive real estate).

Condos: a great alternative starting point for real estate investment in expensive locations

This IS Real Finance Guy, and for those of you that are new to my blog, I’ll tell you now that I am a really big fan of condo investing. It’s true, they have their downsides, but at a high level the benefits far outweigh the costs. For one, they are usually significantly cheaper than single family homes, so you can get into the property ladder for a smaller down payment. Second, they are very low hassle since there isn’t any exterior maintenance to worry about, and many other potential hassles are taken care of by the condo association.

My own path in real estate investing started in 2015 when I purchased a run down, older condo in the up and coming neighborhood of Ballard in Seattle. After a hectic 6 months buying, renovating, and renting out the condo, I’ve seen exceptional return on investment, and I spent less than 10 hours “landlording” for the entire year of 2018. Easy-peesy.

MIL units: Another way to create value in expensive real estate markets

Many cities with a significant amount of single family homes also have provisions for detached, or separate mother-in-law units on the property. For instance, my hometown of Seattle will let anyone with a 5000 sq. ft. lot to place an 800 sq. ft. mother in law unit on their property, as long as there is off-street parking and access to the unit from a back alley. The homeowner is also required to live on the property.

Although these units cannot be purchased or sold separately from the main home that they are attached to, those who purchase a personal home that meets those characteristics can construct a mother-in-law unit, and rent it out. There is even a company in Portland that creates very nice pre-manufactured detached units that can be delivered and placed onto the property for around $100k-$125k. It’s true, that is a lot of money. But, it is way less than the $150-$200k one would need to set aside for a down payment to buy another single family home to rent out.

The best part? A unit like that in a decent part of town in Seattle could easily rent for $1750-$2000 per month; that’s $24,000 per year. I’d happily lock in that 25% return (24k=25% of $100k).

For those with even more frugal tendencies, there’s one more hack. Although the homeowner is required to live on the property (in Seattle at least), you can live in the MIL and rent out the main home (presumably for significantly more). This is one of my favorite real estate strategies.

Investment groups: If you can’t buy the whole house, buy part of it!

Although going out on your own as a real estate investor in an expensive real estate market can be difficult, that doesn’t mean that there aren’t ways to start investing with others. There are a couple of different tacks you can take here.

Bring a friend

Quite simply, find a like-minded friend or two and save up enough of a down payment that you can buy a property and ensure decent free cash flow. This method also has the advantage of enabling you to spread out the burden of landlord responsibilities across multiple people.

Find a development group

There are numerous private development groups that need investors for their projects. Investments in projects like this will often start at around $50k. Although that isn’t cheap, it’s much cheaper than any of the other strategies I mentioned above. Development is generally higher risk than other forms of real estate investing because the developers need to highly leverage each project to make decent returns, so this isn’t a strategy for the light of heart. At the same time, returns can be fantastic if things go properly and the market holds together.

Buy a REIT

Although this is a bit of a cop out, I think it’s an option people often forget about so I’ll list it here. A REIT, or real estate investment trust, is a tax advantaged company that invests in real estate for the purposes of generating income for the investors. Many REITs are publicly traded, so all you have to do is have a brokerage account and enough for a single share. You won’t get the advantages of leverage, but you can at least participate in the real estate market.

Don’t let expensive real estate stop you from real estate investing

Hopefully, after reading this post you are fired up to go out and start real estate investing. Just because you live in an expensive city doesn’t mean that you can’t take advantage of the incredible leverage and benefits that real estate can offer.