Using debt as a forced savings plan

An easy way for me to developed a forced savings plan

Over years of reading about personal finance, I’ve repeatedly seen two narratives told over and over again. First of all, debt is bad. Who wants compound interest working against them? Second, although debt is bad, having a mortgage is alright because it acts like a forced savings plan, slowly enabling borrowers to build wealth in a (theoretically) appreciating asset.

Although I generally agree with both of these narratives, it’s an awfully narrow view of the world. Why can't the “forced savings plan” idea can be extended beyond simply mortgage debt, if executed intelligently with low interest, short term debt?

Although it seems to come fluently for many (God bless them), saving is a bitch for me. It’s so hard for me to prioritize the act of saving when I don’t HAVE to. If I don’t save a dollar, there’s no immediate pain or visible consequence. Because of this my saving is erratic.

On the flip side, if I don’t pay my credit card bills, car payment or mortgage, there are immediate, painful consequences. I pay ALL of my debt on time. Although I hate having debt, it's odd how little I mind paying it off every month. It actually comes as a relief, and an excitement in a way because I know my overall indebtedness is being reduced.

That's an interesting contrast to saving where I FEEL like I am sacrificing something. I'm not, in fact it's exactly the opposite, but it feels that way nonetheless.

An observation from my SOFI loan

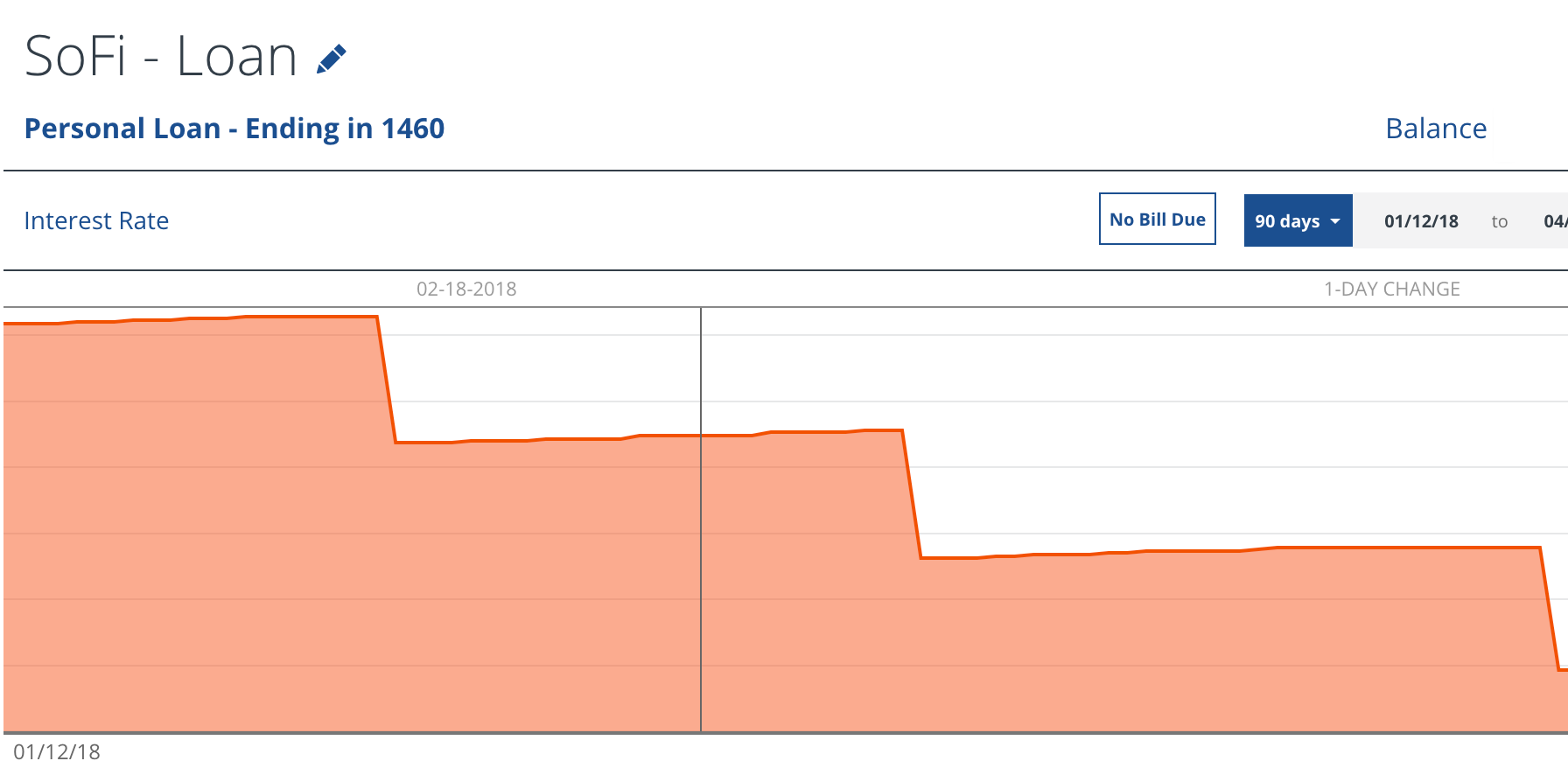

Currently, I have a 5.5% 3 year loan from SOFI that I used to pay off higher interest credit card debt and consolidate a previous loan. The original principle was around $30,000, and the payment is around $900. A lot of money, for sure… but something that comes out of my account every month with relatively little impact since I am used to it.

As I watch the balance drop in Personal Capital, I can’t help but notice that my net worth creeps up a little bit each month, simply due to debt reduction.

A stupid hypocrisy about forced savings

I don’t think anyone from the personal finance world would say that I was dumb to take out a low interest loan to pay off credit cards that were 10% or higher, along with another loan at 8% interest. Every month I am paying less interest… it’s common sense.

But, if I suggested purchasing stock with borrowed money, the conversation changes. It’s essentially investing on margin, although at lower interest rates than most margin debt. I admit this not a risk free strategy. In fact, it’s a risky one! But I have a long time-horizon, and I can handle swings in the market. My thinking: as long as I am able to make my loan payments, I can use debt as a FORCED investment plan. If I HAVE to pay off the debt that I am investing with, it’s essentially the same as forcing myself to invest.

My potential forced savings plan

Using the same $30k loan as a baseline, if I am lucky enough to see 10% gains on my investments I could potentially be making ~4-5% on paper every year. Even if my investments are flat, by the end of the loan term I have $30k of investments that I didn't have before... $30k in investments that I forced myself to make.

I am not sure if I am going to execute this plan. When my current SOFI loan is paid off, there will be a $900 hole in my budget. If valuations are more attractive and interest rates are reasonable, I might end up replacing that loan with another one. I’ll put the proceeds straight into the stock market, with the understanding that there will be a risk of principle loss if the market goes down. For me, that’s better than the erratic periodic investments I have made with spare cash from time to time. If I continue to do it over the course of 15-20 years, I might be able to save an extra $200-300k over what I would have been able to otherwise.

For those that saving comes easy, this plan makes zero sense. But for me, it’s an easy way to force myself to prioritize my investments and savings.