Using different types of diversification in portfolio management

Different types of diversification in portfolio management

The more that I learn, the more I think about investing and how I can be more effective with my portfolio. As the stock market has begun to falter, this has come to the forefront of my mind. Every week or so I find myself looking at the volatility in my portfolio with Personal Capital and wondering how I can be more diversified and therefore more insulated from the everyday ups and downs of each market.

For my grandparents generation, "the greatest generation", diversification was simple. You had some stocks, some bonds, and a house. I'm not saying that my grandparents (or yours) weren't shrewd investors, just that the art and science of investing was much simpler 40 years ago. Their simple strategies worked out just fine in the end: my Mom's parents just passed away and had more than enough money left over to serve their needs for at least 20 more years. Unfortunately, I think it will be difficult to duplicate their success by just buying GE and holding onto it for 40 years... in fact I don't think I'll be buying GE or individual stocks at all.

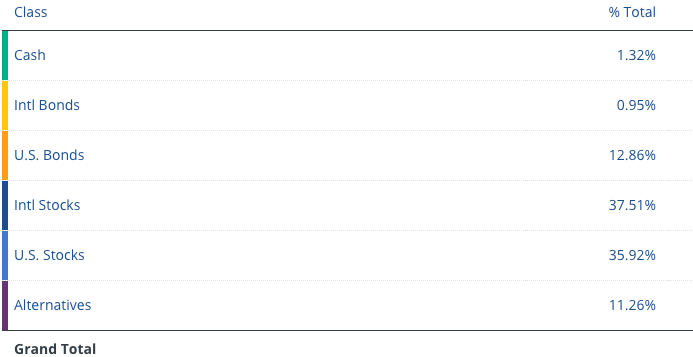

As you can see from my own portfolio snapshot in Personal Capital, below, the world of diversification is significantly more complex these days. It can be tough to know where to get started, so I am going to devote a couple of posts to diversification to try to simplify this concept a little bit. In this first post I will discuss the different types of diversification, and next week I’ll talk a little about how to actually go about diversification.

Types of portfolio diversification

There are so many ways to diversify that it can be hard to keep track. I’ve organized this list in order of importance. In other words, someone who is just getting started on their journey to diversify should start at the top and work towards the bottom. Keep in mind, I am not recommending any specific types of diversification or securities, this is just a list of possibilities.

Diversifying across investment type and asset class

The simplest diversification -and the easiest one to implement- is having multiple types of investments. I don’t think anyone would recommend an investor to ONLY invest in real estate, or ONLY invest in the stock market, or ONLY invest in bonds. Here’s a short list of the types of investments you could consider… and believe me this is a very short list. These are roughly ordered by how risky they are, but every investment carries some amount of risk so tread carefully regardless.

Treasury Bonds

Annuities

Corporate Bonds

Physical real estate

Equities/stocks

Peer-to-peer lending

Precious metals

Mortgage debt (as a lender)

Privately held businesses (e.g. if you are a small business owner)

ISO or RSU stock options

Alternatives (hedge funds, private equity, venture capital)

Collectables (antiques, cars, art, etc)

Commodities

Options/futures/derivatives

Currencies (foreign exchange)

Cryptocurrencies

Personally, I own stocks, treasuries, corporate bonds, ISO stock options and physical real estate. In the future I am considering peer-to-peer lending, a privately held business (maybe the blog?), as well as options and mortgage debt. I don’t know enough about peer-to-peer lending and mortgage debt to jump in right now, but I like the idea of a steady stream of income.

(For stocks) - Diversification by market cap

Market cap is simply a way to bucket stocks by how large they are. Companies with market caps larger than $10b are generally considered large cap, with mid cap covering those stocks between $1b and $10b and small cap everything below $2b. People often focus so much on large cap stocks (S&P 500, for example) that mid and small cap stocks are completely forgotten.

Mid and small cap stocks are often more volatile, risky, and rewarding than large cap stocks.

Personally, I invest an equal amount of my portfolio across small, mid and large cap stocks. I believe that I’ll see better performance from the small and mid cap stocks than the large caps over time. To put it simply, it’s a lot easier for a tiny $200m market cap stock to double in value than for GM or Google to double in value. It’s also a lot easier for them to go out of business. We’ll see if it works out in the long run.

(For stocks) - Diversification by growth/value

Beyond market cap, stocks are often bucketed by whether they are growth or value. This is a little more subjective than market cap.

To put it simply, growth stocks trade at a high(er) P/E ratio and are defined by low or no dividends. These are stocks that people are betting will be more valuable in the future because they are growing so quickly. Value stocks are companies with lower P/E ratios that generally pay dividends. Sometimes, value stocks are in “unsexy” industries like utilities and manufacturing that are unloved by Wall Street. Value investors (Warren Buffett being the most famous example) try to find stocks in companies that are fundamentally undervalued and likely to rise in the future on fundamental business growth.

I don’t have a growth/value strategy, per se. I invest across the board in index funds that cover the market based on market cap and geography, with a broad range of both growth and value stocks. If I had individual stocks, this would be a significantly more important facet for me to diversify across. Someday, I’d love to have the time to do value investing in small caps. There is so much opportunity hidden in those tiny, unloved companies!

Diversifying by market location and stage of development

Although the world is an increasingly interwoven market, there are still huge disparities between regions and countries. The performance of stocks in Europe is very different from US stocks, and Emerging Markets (China, Brazil, etc) behave even more differently.

Market location is the most important diversification facet for me. I am highly exposed to the global stock market with over 37% of my allocation outside of the US. Long term, I firmly believe that emerging and frontier markets will perform better than developed markets. There’s simply so much more opportunity. I’ll admit that from 2010 to 2017 this wasn’t the case, but recently smaller global markets have started to come into their own.

Diversifying across industry

Healthcare, oil and gas, retail, technology… stocks in different industries act differently, which means they can be used as a facet of diversification.

Personally, I am invested in market wide index funds that don’t target specific industries, but there are a wide range of low fee index funds that offer exposure to particular industries. This can be very helpful for people who are trying to achieve certain things. Older people who are interested in income and wealth preservation might consider utilities, which pay higher dividends with less volatility than other stocks. Younger people might prefer the potential appreciation of technology stocks.

I use Personal Capital to keep track of my industry allocation for free, as you can see below. Looks like I am highly exposed to technology… and I work in technology. Not a great overlap!

(For bonds) - Duration/maturity

Bonds behave differently depending on the length of time that they have until they mature. This is due to something called duration risk. If interest rates are currently 10%, and they fall to 5%, a bond that pays 10% over 20 years is significantly more valuable than a bond that pays 10% over 1 year. It works the other way too. Currently, interest rates are rising, which is pushing the price of all bonds, and particularly long term bonds, down.

I am invested in mostly longer term bonds. They pay higher interest rates, but are also exposed to more duration risk. They are still providing a very nice cushion agains the broader stock market declines of late, as this view from Personal Capital shows. I am only down 1.15% versus 2.59% for the S&P 500.

(For bonds) - Credit rating

Not all bonds are created equal! Bonds that are issued by companies like Tesla -that are presumably about to go bankrupt- pay a lot higher interest rate than less risky companies like Exxon Mobil. The highest credit rating is (depending on the agency) usually AAA, which is essentially risk free.

Generally, I only invest in bonds with at least an A credit rating. My equity investments are much more risky, and I look to my bonds as a source of stability. After the financial crises, junk bonds (non-investment grade) were hit really really hard. Those that were smart enough to pick up some carefully chosen bonds in 2009 made a killing, bringing in 10-20% per year on their investments. After the next crisis or downturn, I will definitely be looking to do the same.

What am I missing?

This is just the starter list of different forms of diversification. If you want to see how well you have diversified already, Personal Capital makes it easy to see exactly what exposure you have to different asset classes. In fact, their allocation advisor even looks into the funds themselves to see what the holdings are. For example, even though I don’t actually own a “international bonds” fund, you can see that I have 1% exposure to international bond markets. Sign up for free to give it a try yourself.