Creating a vesting schedule for startup stock options

How to create a stock option vesting schedule spreadsheet

Congrats! If you are reading this, chances are you have just been granted some options. After you have a basic understanding of what stock options are, and some potential pitfalls to avoid, the next step to figure out the financial impact of your options is to create a vesting schedule.

Vesting schedule definition

A stock option vesting schedule is a timeline or spreadsheet that displays the amount of stock within a stock option grant that is able to be purchased by the grantee (for ISOs), or has already been transferred to the grantee (in the case of an RSU).

Why is this so important?

Some people don't think vesting schedules are necessary, but they serve a couple of important purposes.

They give you an idea of HOW LONG it will take to fully vest your stock. Sometimes it seems like the top line grant number is a foregone conclusion, but the truth is that you have to stay at the company for the duration of the grant until it fully vests. Most people don't fully vest their stock grants.

A vesting schedule shows you how much your stock COULD BE worth at any given time. There aren't any guarantees, but a great vesting schedule will enable you to model how much money your stock will be worth in different circumstances.

They help you to plan. By understanding the potential value of your stock, you can use your vesting schedule to plan your investments and other financial moves over time.

How to get started creating your own vesting calculator

There are many different ways to create a vesting schedule spreadsheet. In the old days, I used to create my vesting schedules with Excel or Google Sheets to map out my grants and figure out how much they might be worth to me. Now, there are multitudes of free tools like Personal Capital that you can use to create vesting schedules without undue effort. With Personal Capital, there is also the added benefit of being able to add the rest of your accounts and investments for a more comprehensive view of your financial status.

Here's how you actually get started creating your schedule with Personal Capital. If you don't have an account, you will need to sign up first (it's completely free, and I am personally a user, but I do have an affiliate relationship with them).

Step 1: Log in and click the "+" button to add a new account

Once you log in to Personal Capital, you'll need to click the + button at the top right hand corner of the accounts list to add a new account, and then select the "More" option at the bottom right hand corner.

2. Select the type of account

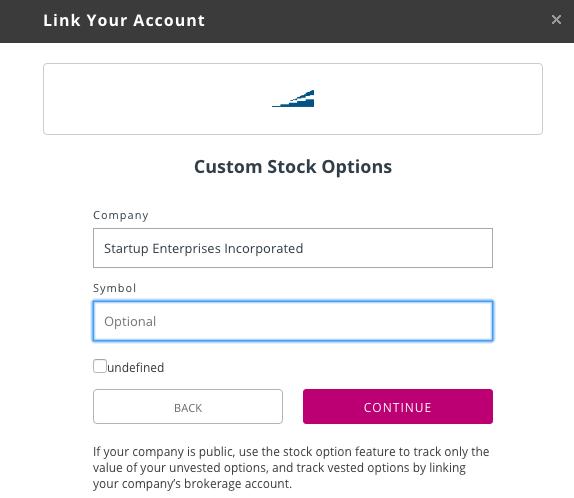

This part is pretty easy, you want to choose the "Custom Stock Options" one. You'll notice there are a lot of different things you can keep track of, however.

3. Fill in the basic company details

Depending on whether your company is public or not, you will either fill in the ticker symbol (Public) or not (Private).

4. Fill in each individual stock option grant

This is the important part of your vesting calculations. You'll need to go in and get the specific number of shares, strike price, current price (or price at IPO) and other details. If you have public company stock this will be a little simpler because Personal Capital will grab the stock price for you.

Stock option vesting schedule example

Once you've loaded all of your grants, you'll get a nice, visual vesting schedule to check out. Keep in mind that the numbers that you see are heavily influenced by the quality of the inputs, so if you get the strike price, share numbers, or future pricing off, what you see will not be accurate. What's more, if you have ISO's remember that you will need to purchase your shares as well!