Turning recurring expenses into recurring investments

Making your bills do the work for you

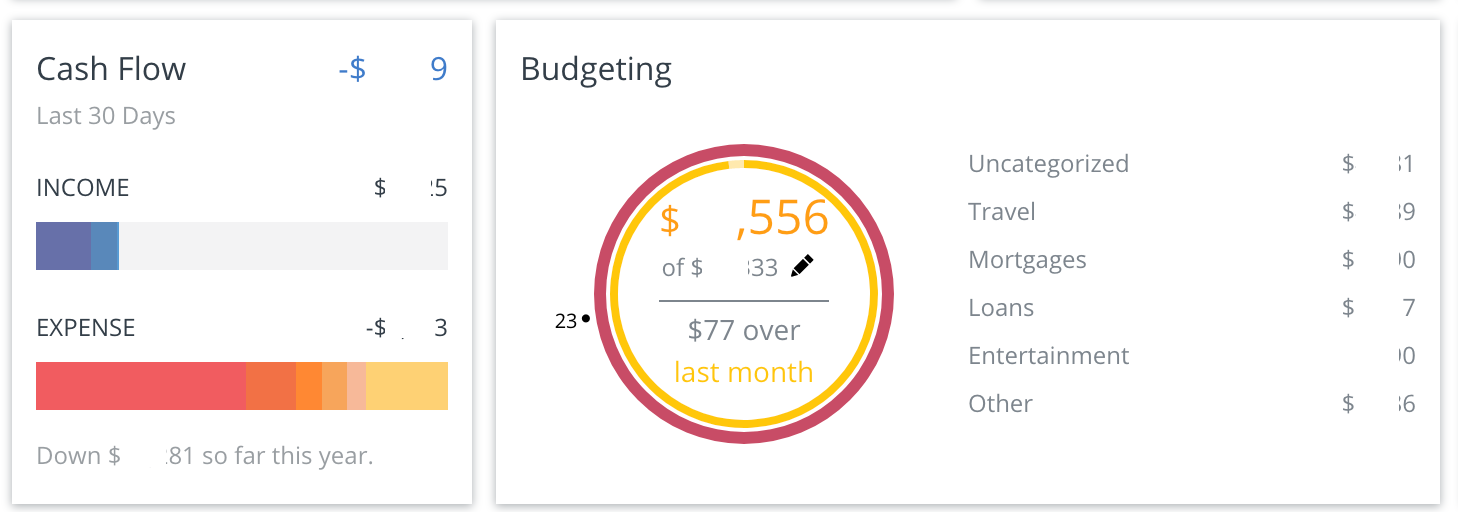

Life is expensive, and that can make it really hard to save. With rent, cell phones, cars, healthcare, food, childcare, vacations and thousands of other little costs, it’s not unusual for someone to have 80-90% of their income disappear into the ether. To be clear, I like having a roof over my head just as much as anyone; I definitely find value in paying rent, but it’s frustrating that I’ll never see that money again. The same is true for all of the recurring payments in my life. Every week when I look at Personal Capital I wonder how I can decrease my expenses, or turn them into investments in some way.

Cash flow in Personal Capital - too many expenses!

To that end, I've been thinking of some ways that I can turn some of those recurring payments into recurring investments, or at least mitigate them so I don’t lose so much of my income to recurring expenses each month.

The biggest expense to turn into an investment

The biggest expenses are actually the easiest ones to turn into investments. Going from a home renter to a home buyer is the most obvious one. Paying $2000 in rent is essentially flushing $2000 down the drain, but buying a home with a $2000/mo mortgage payment will yield at least $300 a month towards the principle of the loan, helping to build equity. That doesn’t even account for the potential appreciation of the home, which can add up to big gains quite quickly. Even people who can’t afford a full down payment can get started as homeowners with tools like Unison, or low down loans. I've seen arguments against homeownership (appreciation isn't guaranteed, maintenance is a pain, etc), but nothing to dissuade me enough from changing my mind.

Going from rent to mortgage is a win, but what about the other big expenses in life?

Turning a car into an investment

Our biggest expense beyond rent is our car... it takes a healthy bite out of our income every month. I don’t have a problem with that necessarily - we made the choice to lease and not buy, viewing the car as the cost of transport from A to B when public transport isn’t possible. It was certainly much cheaper than buying, but I will admit that the money we spend on the lease isn’t building any long term value. It’s an expense, not an investment.

Unfortunately, buying a car outright isn't much better. It’s quite well documented that new cars lose 10-30% of their value the moment they are driven off of the lot. Even older, used cars lose a significant portion of their value over time. Although used cars lose less of their value over time, I would never use the word “investment” to describe an ‘05 Camry. It might be a very practical and relatively cheap mode of transportation... but it's not an investment.

But... some cars DO appreciate in value. Admittedly, it’s a relatively small subset, but cars that will become collectible or more collectible can pay for themselves over time. When I was in high school, one of my friends bought a ‘59 Ford Fairlane in poor -but driveable- condition for $7000. Four years later, after having put 20,000 miles on the car, he sold it for $9000. Not a big gain, but it paid for the maintenance the car needed during the time that he owned it.

This isn’t limited to crappy older cars either. One car I’ve kept close tabs on over time is the 1999-2003 BMW M5. I've always liked the car and hoped to buy one someday. In 2014, an M5 with 30-50,000 miles on it would go for around $25,000. Now, as you can see quite clearly, even examples with 70,000 miles or more are going for $30,000 plus. If I had been smart enough to buy one of these in 2014, I would have been driving around in an appreciating asset! Even accounting for the miles I put on it, along with maintenance and insurance costs, it would have paid for itself over that time period.

You might think this is an isolated incident with an isolated car, but for those in the know or with the desire to look into it there are opportunities all over the place. I am not guaranteeing success with any car, but it’s better to try to buy something that’ll appreciate than resign yourself to the reliable, mundane depreciation of a Camry. Chances are, you’ll have a lot more fun driving a future collectable as well. Look at that - exciting, appreciating, and somewhat practical with four doors.

Closing thoughts

Beyond the two big expenses you see above, the blogosphere has already detailed a lot of additional ways that you can turn everyday expenses into something of lasting value. Instead of buying a $200 table on Wayfair, go to a yard sale and buy a $50 table you can refurbish. This type of thing isn’t in my wheelhouse… so I probably won't be doing it. If you're comfortable with that kind of thing, it’s a great idea to reduce some costs.

I also think there’s a way to turn vacations into an asset by buying an investment vacation property that can be rented out for most of the year on Airbnb. I am sure the numbers could be fudged enough to make it work on paper, but the effort would probably be a little bit too much for the potential gain. I've heard a lot of Airbnb horror stories (from the perspective of the owner), and I am not sure I'd like having the property vacant every two days. It’s definitely something I’ll look into at some point, but for now I am trying to keep it simple.

What am I missing? How do you turn your recurring expenses into investments?